Hardy Managed Portfolios – February 2026

Our strong performance has continued into 2026, following a solid outperformance in 2025.

We have seen a notable acceleration since last autumn, driven by our increase to gold & silver equities in our September rebalance, just in time for the strong rally they have experienced since then. Performance has also been helped by our overweight positions in Asia & Emerging Markets, EU and Japan, and underweight to US / Technology which has continued to lag.

Gold & silver prices have been more choppy than usual in the last few of weeks, but nothing has changed regarding our positive outlook for the sector. Volatile macroeconomic and geopolitical conditions continue to favour gold as a reserve asset for central banks, while persistent inflation and concerns about unsustainable government debt levels point towards financial repression ahead, driving investment demand for precious metals as a means of wealth protection. In addition, demand from technology (particularly for silver in AI, solar, health etc) is strengthening.

Questions around AI’s long-term profitability and elevated valuations could weigh on sentiment

After three years of robust gains in equities, we expect 2026 to bring greater volatility. Questions around AI’s long-term profitability and elevated valuations could weigh on sentiment, while spreading geopolitical uncertainty will likely add to market crosswinds; against this, we continue to find certain sectors and themes on attractive valuations. We are maintaining our bias to the cheaper equity markets and more predictable Alternatives, with gold and silver as “insurance” against the growing risks, as the best approach for the opportunities in year ahead.

We are preparing our next portfolio rebalance and will communicate further details in due course.

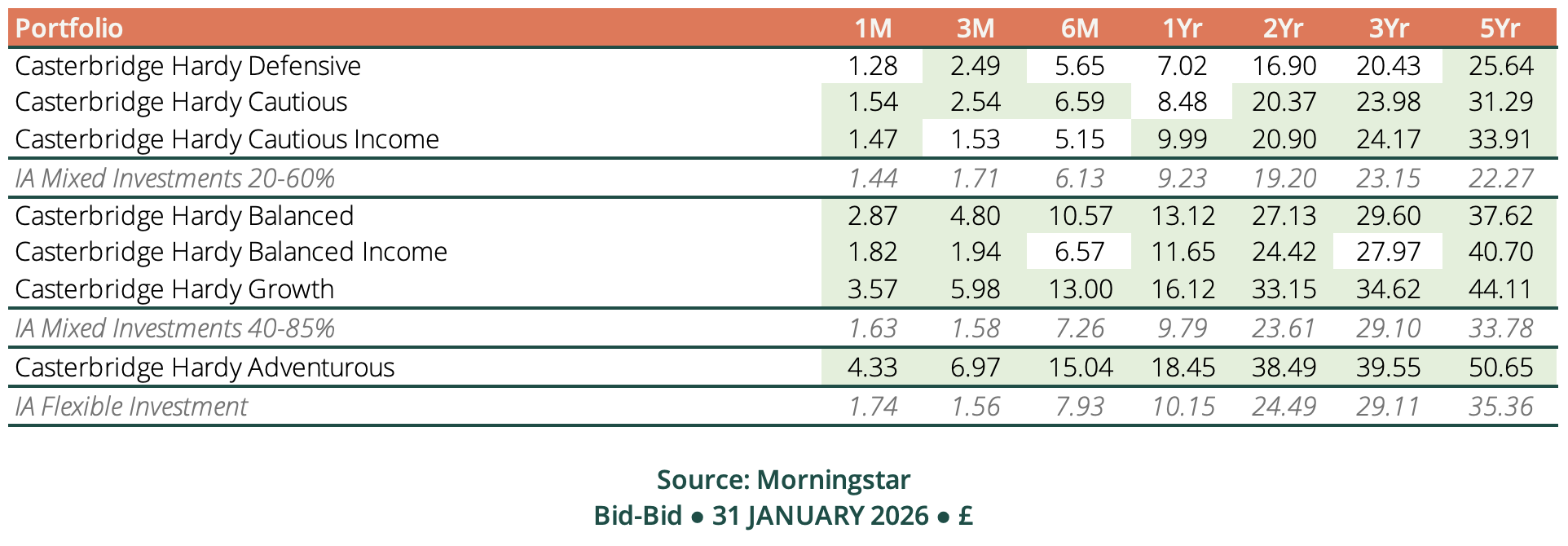

Performance numbers

Important Information

This article is for information only and does not constitute advice or recommendation and you should not make any investment decisions based on it. The views and opinions of this article are those of Casterbridge at the time of writing and may change without notice. Any opinions should not be viewed as indicating any guarantee of return from investments managed by Casterbridge nor as advice of any nature. It is important to remember that past performance and the value of an investment, and any income from it, may go down as well as up and the investor may not get back the original amount invested.