Upgrades to the Casterbridge Hardy Managed portfolios:

Like all high-performance teams, we have been conducting a review of our Hardy Managed Portfolios to see where we can fine-tune what is already recognised as an outstanding range for investors.

As part of this review, we critically assessed how we manage the investments from several different viewpoints. This included our well-respected top-down macro forecasting, as well as our day-to-day processing, and exploring how to improve the adviser experience of the Hardy range.

The review was driven by our desire to continuously develop our product to remain ahead of the competition, and has resulted in the following upgrades:

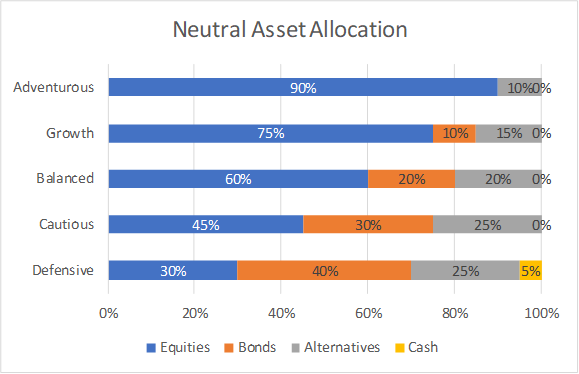

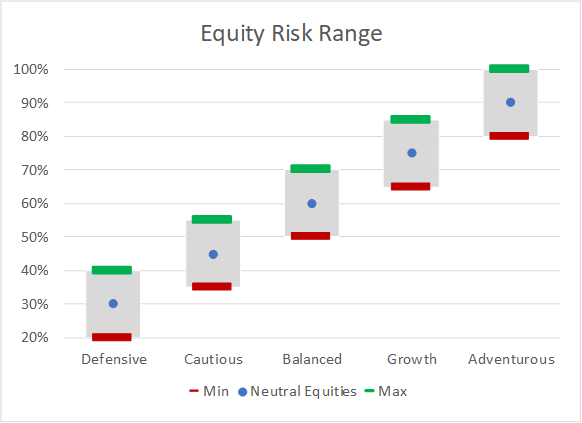

1. Better-defined asset allocation: Better defining the asset allocation of each portfolio will mean advisers can identify which portfolio is most suitable for their clients.

We’re tweaking the bandings for our equity weightings within each portfolio, making them clearer and helping you more easily match clients to their most suitable portfolio.

We know that clients with a higher capacity for loss are prepared to accept a higher risk, so our Growth and Adventurous portfolios will now take more appropriate risk. Our Adventurous portfolio can now also be fully invested in equities, if required.

Here’s how this works across the portfolio range.

2. Improvements to portfolio construction: We are adapting our approach to give our investment team greater flexibility to deliver appropriate client outcomes.

Previously, we used Hardy 5 as our central decision-making portfolio, building out the rest of the portfolios in the range. Now, we will manage each of the portfolios individually. While there will be consistency in our use of ‘core’ funds across portfolios, you can expect some greater differentiation in our use of ‘satellite’ funds, which will be used to dial risk up or down in each portfolio, as deemed appropriate.

3. Simplifying portfolio names: We’re also taking on board adviser feedback by bringing the names of the Hardy portfolios in line with more widely used MPS market terminology.

So, we’re changing the names from Hardy 3, 4, 5, 6 and 7, to Hardy Defensive, Cautious, Balanced, Growth, and Adventurous. As well as simplicity, we want to help give you greater clarity on client suitability per portfolio.

Hardy 3 is now Hardy Defensive

Hardy 4 is now Hardy Cautious

Hardy 5 is now Hardy Balanced

Hardy 6 is now Hardy Growth

Hardy 7 is now Hardy Adventurous

These upgrades will be implemented from the next rebalance, which is expected in the coming days. The changes to portfolio names may take a few days to update on some external platforms.

As always, if you need any more information, please don’t hesitate to contact Emma Foley or Matt Cheek.

Important Information

This article is for information only and does not constitute advice or recommendation and you should not make any investment decisions based on it. The views and opinions of this article are those of Casterbridge at the time of writing and may change without notice. Any opinions should not be viewed as indicating any guarantee of return from investments managed by Casterbridge nor as advice of any nature. It is important to remember that past performance and the value of an investment, and any income from it, may go down as well as up and the investor may not get back the original amount invested.