Welcome to this first update on the new Boldwood portfolios.

The Boldwood Portfolios are being managed by the experienced team at Casterbridge, working closely with input from Nathan, Olly and Theo. This note is to provide a short update on markets and talk about the changes we have made recently to the portfolios.

Return of inflation…

One of the key themes we have been discussing at Casterbridge for the last 18 months or so has been the likely return of inflation after 30 years of falling prices. We anticipated that inflation was likely to return, and potentially with a vengeance, once the global economy was unleashed post-lockdown. This proved correct, with UK inflation at 7% before the war in Ukraine started – the conflict itself pushing prices even higher as supplies of energy and other commodities were disrupted.

As a result, Boldwood portfolios started underweight to Bonds and instead used more defensive absolute return bond strategies. This stance helped protect portfolios from the worst of the bond market turmoil seen in 2022, where many bonds fell around 30% before stabilising towards the end of the year.

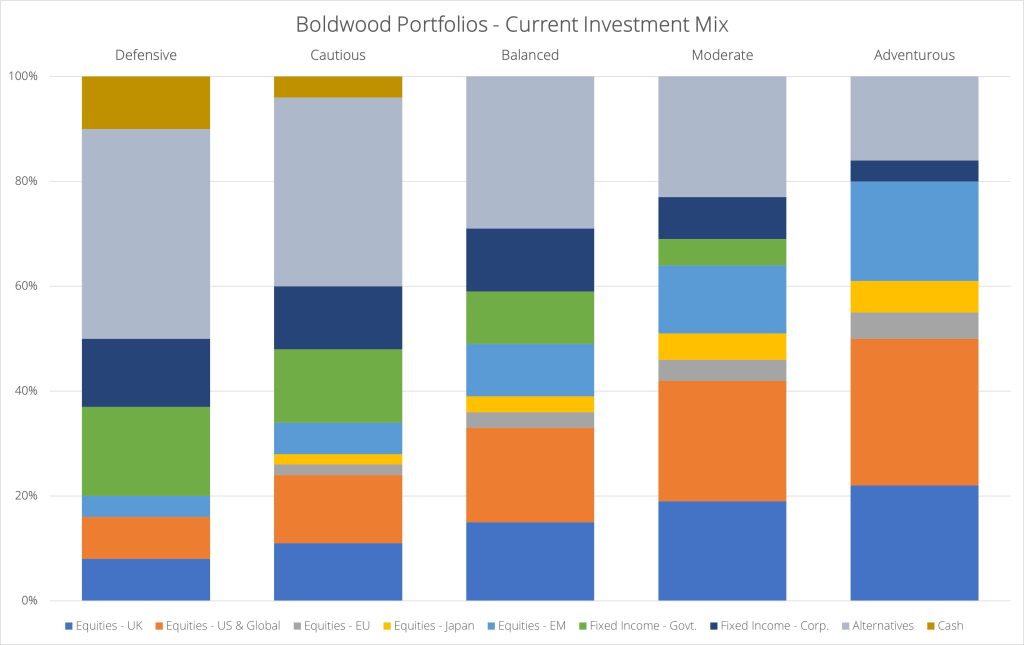

What the Boldwood Portfolios look like

Approaching the peak

Now that we are hopefully closer to peak inflation and the market is forecasting falling bond yields, we have switched some of the absolute return bond funds into long bond positions to capture attractive yields and the potential for capital appreciation. We are buying US Treasuries with yields of around 3.5%, with the added benefit of increasing US$ exposure which should provide some protection in a “risk-off” environment. We are also buying UK corporate bonds through a fund manager who has demonstrated a good track record of being nimble and navigating the challenges of greater volatility in this market; this fund currently yields 8-9%.

Elsewhere, we continue to be underweight Equities. We feel that markets are too optimistic in terms of stronger economic and profits growth, and have run ahead of themselves in anticipation of falling inflation and interest rates. At the same time we have growing geo-political risks in different regions of the world. We are, however, introducing one new fund, a broadly diversified commodities fund which gives exposure to Energy, Mining and Agriculture equities and is attractively valued – we believe that we could be towards the start of a multi-year bull market in commodities and so feel excited to introduce this fund into portfolios.

Important Information

This article is for information only and does not constitute advice or recommendation and you should not make any investment decisions based on it. The views and opinions of this article are those of Casterbridge at the time of writing and may change without notice. Any opinions should not be viewed as indicating any guarantee of return from investments managed by Casterbridge nor as advice of any nature. It is important to remember that past performance and the value of an investment, and any income from it, may go down as well as up and the investor may not get back the original amount invested.