In this first of our ‘fund in focus’, Annie Borg, Research Analyst on the Casterbridge Research Team, gives some background to one of the new funds purchased within the Sustainable Impact portfolio; explaining why Annie believes the fund will be a core holding and what it offers investors.

WHEB Sustainability – A leader within ESG investment

With the continued uncertainty within the market, it is difficult for investors to know where to place their funds, with many simply increasing their exposure to growth as an investment style and favouring mega capitalised companies. So where should we be invested? As well as being able to ride out the ‘COVID storm’, we wish to be invested in companies which are going to continue to grow market share in the future and not just hold companies which will produce stable returns during the pandemic.

Our portfolios do have exposure to large-cap growth stocks with high cash on their balance sheets for core economic protection, however the investment team are also using the market falls as an opportunity to purchase direct stocks and collective funds which are going to be the leaders of tomorrow. At Casterbridge, we believe that these stocks are likely to be those that can adapt to the changing market environment, the so called ‘fourth industrial revolution’. The themes of Technology, Healthcare and Global Demographics are going to be major factors of the future. To target this aim, The Casterbridge Sustainable Impact portfolios purchased the FP WHEB Sustainability fund in June 2020.

Through focusing on investing in companies providing solutions to sustainability challenges and growth at a Reasonable Price (GARP) approach, the WHEB fund seeks to benefit from investing within opportunities created by the transition to a low carbon and sustainable global economy. Centred around sustainability, growth and quality, the fund’s process concentrates on nine sustainable investment themes: five environmental (Resource Efficiency, Cleaner Energy, Environmental Services, Sustainable Transport, Water Management) and four social themes (Health, Safety, Wellbeing and Education). WHEB believes that through focusing on companies that provide solutions to critical social and environmental needs of the future, the fund can deliver superior growth prospects. It is the investment team’s aggregated 130 years of Sustainable Investments industry experience which lends the fund credibility in devising sustainability themes and the complex technologies that allow the fund to add value over the long-term.

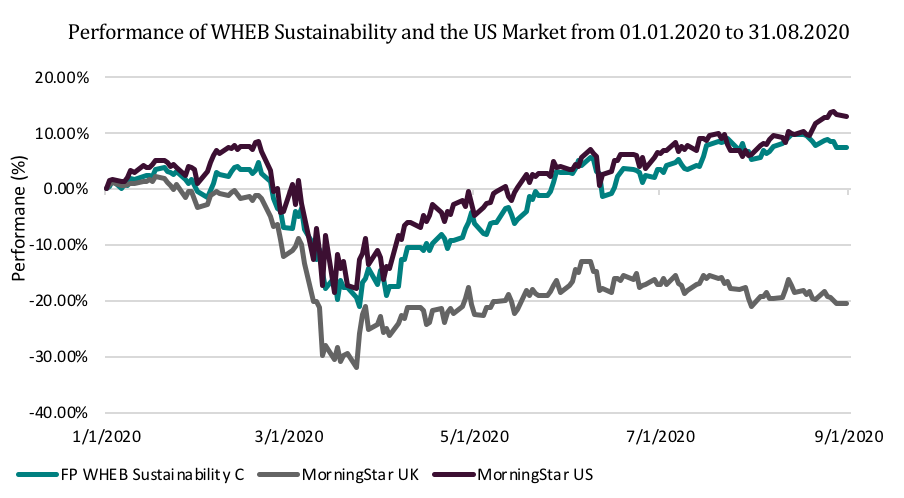

These established themes of tomorrow are also sectors where demand has been accelerated by the Coronavirus. Sectors such as healthcare and technology having to advance quicker than planned to meet the ever-changing pandemic environment, the fund has been able to continue to produce returns throughout the year with a ‘positive impact’. The portfolio has access to companies with new technologies such as providing ‘TeleHealth’ and resource efficiency services (key products within the pandemic) whilst further emphasising quality, robust business models within companies with products/services differentiated to the rest of the market. When compared to the US market which has dominated through a ~25% exposure to the mega cap FAANG stocks of Facebook, Apple, Amazon, Netflix and Google, the fund has made strong returns of 7.32% against the US performance of 12.92% on a year to 31.08.2020 period, also outperforming the UK market (see chart below).

| Source: MorningStar Direct 2020 |

The portfolio continued to provide positive returns for the year through the uncertainty and managed to do so with a well-diversified portfolio which is mid-cap focused, diversifying away from the returns of FAANG stocks despite being 62% within US equities. The fund also aims to meet all 17 United Nations Sustainable Development Goals (SDGs) – resulting in a truly positive active footprint on the world. WHEB is also a certified ‘B’ corporation, is rated 5 stars by 3D investing and is a signatory to the Principles of Responsible Investing (PRI), solidifying WHEB’s position as a market leader within Impact Investing. Operating with a high level of disclosure, the fund publishes all voting records, advisory minutes, and the European Sustainable Responsible Investment transparency records on the WHEB website. Further, the fund produces an annual Impact Report, giving a full outline on the impacts (both positive and negative) made though investing within the strategy and allows investors to calculate the true impact that a clients money is having on society. Due to the emphasis on making improvements within the world we live in and the diversification benefits of the fund, WHEB Sustainability is expected to remain a core holding within our Sustainable service for years to come.

Annie Borg, Research Analyst Casterbridge Wealth.

Important Information

This update is for information only and does not constitute advice or a recommendation and you should not make any investment decisions on the basis of it. The views and opinions within this document are those of Casterbridge Wealth at time of writing and may change without notice. They should not be viewed as indicating any guarantee of return from an investment managed by Casterbridge Wealth nor as advice of any nature. Past performance is not a guide to the future. The value of an investment and any income from it may go down as well as up and the investor may not get back the original amount invested.