A number of clients have been asking the question: ‘why should I stay invested when I can get around 5% on a fixed term savings account?’

James O’Hara, one of our Investment Managers looking after Bespoke portfolios penned the below response to one particular client who asked the question. I thought it to be a really good explanation of the current environment, why savings rates are where they are and the risks associated from those rates. James also expands on the potential loss of growth opportunity by coming out of a well diversified investment portfolio…

This is something we’re thinking about ourselves at the moment and how to reflect a similar view on portfolios. There are time deposit accounts or money market accounts that can currently offer very competitive rates around 5%, but even Money Market funds which are coined as ‘Risk-Free’ are not the same as holding cash. Thinking back to 2007/08, these funds had a torrid time when the liquidity disappeared and with liquidity likely to come under pressure again, we are wary of adding too much to these crowded areas. There are cash funds available we are looking into that benefit from economies of scale which only use the overnight facility at the central bank which provide a more modest yield of 2.5%-3%, but without the risk of the intricate mechanics money markets funds use for higher yields or locking your cash up for a specific period.

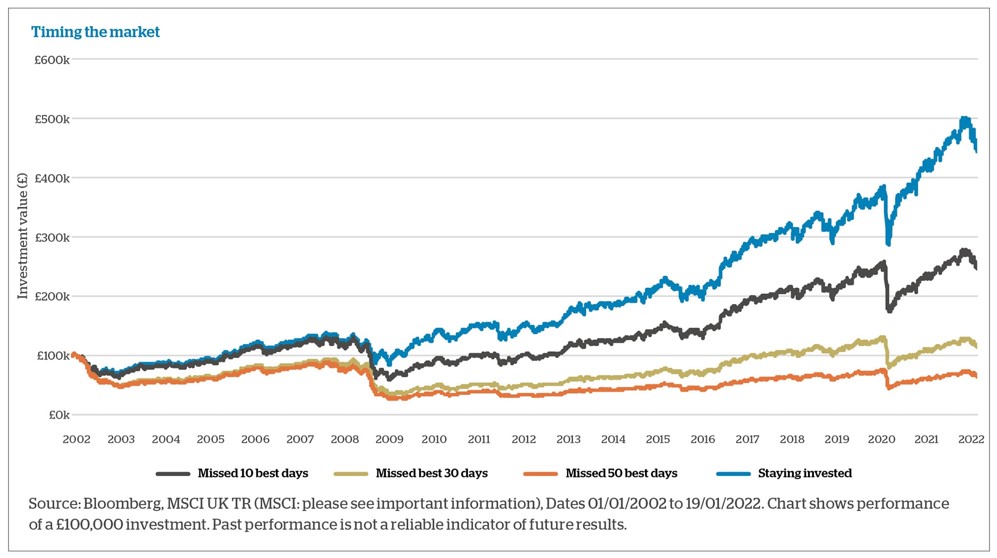

Recoveries do tend to be very swift and follow not far after the fall, which makes sitting on the sidelines in cash and timing the re-entry very difficult to do

We are actively moving into quality companies with strong yields, particularly in the US where the ‘Top 7’ tech firms are eye-wateringly expensive, so we can provide a similar income that could be available in a short-term deposit account. This also allows us the opportunity to still have the benefit of capital appreciation when the recovery does come. Recoveries do tend to be very swift and follow not far after the fall, which makes sitting on the sidelines in cash and timing the re-entry very difficult to do. Interest rates will also likely fall just as quickly as they have risen and any extended period of higher rates will be damaging for the economy in the long run.

We have been underweight equities vs our Strategic weighting, but have been gradually moving towards it adding stocks on valuation grounds as we have ridden up the AI-led rally. But we have also built out our Fixed Income and Alternative allocations to work for us when there is market volatility. We have a healthy mix of hedge fund-like holdings which can benefit from going long and short in the current environment, private equity which holds up well and avoids the fire-sale nature of big market sell-off’s and Infrastructure which provides inflation-linked exposure to real assets. This diversification of assets helps provide some shelter from the storm when equity markets get a kicking.

We are of similar mind to you as you say regarding the global slowdown, however, the bond market has been pricing this in for months all while stock markets have hit all time highs. Taking a large bet here on the market to fall by reducing risk in a big way could mean we stand to miss out on this rally that could continue – we had a similar feeling we had in 2017 where we foresaw central bank intervention, but markets didn’t move as expected until the latter of 2018. The key in the coming weeks and months will be the headline inflation figure and unemployment – unfortunately it does need to get a bit worse for a moment as consumer spending and wage growth has allowed inflation to stay elevated.

In short – we are being more risk averse here in terms of not adding equity over and above our strategic weight, we’re adding quality yield to bolster total return and maintaining the ability to participate in the rallies. But we are always also tapping the ground for potential pitfalls where we can reduce the accelerator in order to protect more capital and provide dry powder to buy into weaker markets.

Important information

This article is for information only and does not constitute advice or recommendation and you should not make any investment decisions based on it. The views and opinions of this article are those of Casterbridge at the time of writing and may change without notice. Any opinions should not be viewed as indicating any guarantee of return from investments managed by Casterbridge nor as advice of any nature. It is important to remember that past performance and the value of an investment, and any income from it, may go down as well as up and the investor may not get back the original amount invested.